Highlights of the MSME and MTC Roadmap

10 June 2024

The Securities Commission Malaysia (“

SC”) launched a roadmap entitled “

Catalysing MSME and MTC Access to the Capital Market: 5-Year Roadmap (2024–2028)” (“

the Roadmap”) on 23 May 2024.

This article highlights the key elements of the Roadmap.

Purpose of the Roadmap

The broad aim of the Roadmap is to better position the capital market as an attractive source of financing for micro, small and medium enterprises (“

MSME”) and mid-tier companies (“

MTC”).

On a more granular level, the purpose of the Roadmap is to:

- Support MSME and MTC financing towards propelling economic growth and job creation;

- Enhance the attractiveness of the capital market for MSME and MTC; and

- Build a more inclusive capital market.

The key outcome

The key outcome sought to be achieved by the Roadmap is to increase MSME and MTC capital market fundraising by more than 5-fold from RM6.3 billion in 2023 to RM40.0 billion by 2028.

Implementation

The implementation of the Roadmap will be spearheaded by the SC and supported by the Ministry of Finance, the Ministry of Investment, Trade and Industry, the Ministry of Economy and the Ministry of Entrepreneur and Cooperatives Development.

A Delivery Management Office (DMO) will be established to monitor and report on the progress of the implementation of the Roadmap and to escalate issues for resolution.

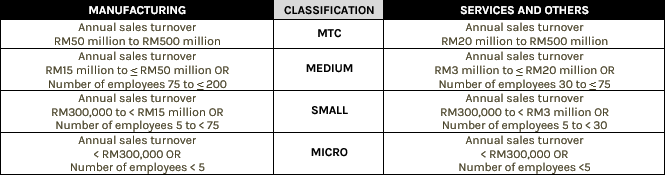

Key definitions

In addition to MSME and MTC, startups are also covered by the initiatives under the Roadmap.

The classification of these categories of enterprises

1 is as follows:

‘Startups’ refer to technology- or innovation-enabled early-stage businesses with a scalable business model and a high-growth strategy.

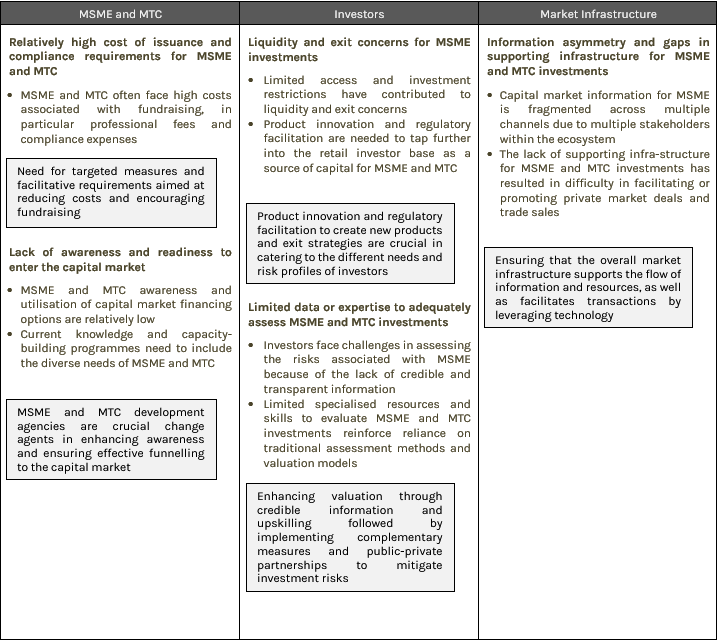

Gaps and Opportunities

The SC has identified the following five significant gaps that will be addressed by the Roadmap:

Guiding Principles and Strategies

Five guiding principles have been set out in the Roadmap to boost MSME and MTC access to the capital market. These principles will form the foundation for the nine cross-cutting strategies and 36 initiatives under the Roadmap.

The Five Guiding Principles

The Nine Strategies

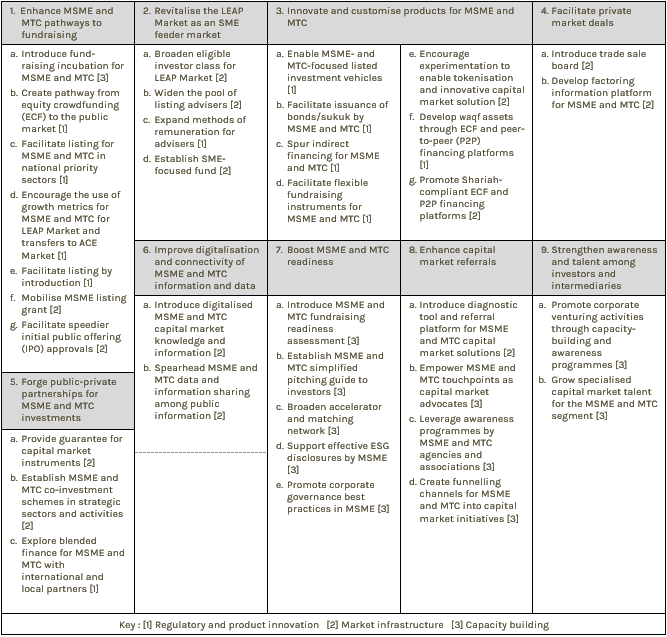

The nine strategies set out in the Roadmap are as follows:

- Enhance MSME and MTC pathways to fundraising

Provide multiple pathways and facilitative requirements for fundraising in the capital market.

- Revitalise the LEAP Market as an SME feeder market

Crowd-in investments and introduce flexibility to enhance attractiveness of the LEAP Market.

- Innovate and customise products for MSME and MTC

Innovate capital market instruments/ vehicles to facilitate MSME and MTC fundraising and investor access.

- Facilitate private market deals

Increase capital market access for MSME and MTC through development of innovative supporting infrastructure.

- Forge public-private partnerships for MSME and MTC investments

De-risk MSME and MTC investments through mechanisms to reduce risks for investors such as through guarantees and involvement of public institutions.

- Improve digitalisation and connectivity of MSME and MTC information and data

Bridge knowledge gaps in the MSME and MTC financing ecosystem by enhancing data and information sharing infrastructure.

- Boost MSME and MTC readiness

Develop necessary skills and tools to prepare and assess MSME and MTC readiness to access the capital market.

- Enhance capital market referrals

Increase awareness and capital market referrals through MSME and MTC touchpoints.

- Strengthen awareness and talent among investors and intermediaries

Educate capital market talent with the necessary skills to assess MSME and MTC investments to boost investment activities.

The Three Approaches

The 36 initiatives under the Roadmap can be classified into three approaches, namely:

- Regulatory and product innovation;

- Market infrastructure; and

- Capacity building.

The 36 Initiatives

The 36 initiatives to be implemented under the Roadmap are as follows:

The initiatives will be implemented in three phases: short-term, medium-term and long-term. Short-term initiatives are those that will be rolled out in 2024. Medium-term initiatives will be implemented between 2025 to 2026 and long-term initiatives will be rolled out between 2027 to 2028. These are in addition to on-going initiatives that were launched prior to the unveiling of the Roadmap.

Comments

The importance of MSME and MTC to the Malaysian economy cannot be overstated. According to the Roadmap, MSME contributed more than 38.4% to the county’s gross domestic product (GDP) and employed almost half (48.2%) of the workforce in 2022. MTC, which number approximately 8,500 enterprises, contribute around 36% to Malaysia’s GDP and employ over 16% of the workforce.

It is hoped that the implementation of the initiatives under the Roadmap will enable the Malaysian capital market to become a major pillar to support the growth of MSME (including startups) and MTC and bring about greater economic growth and employment opportunities in Malaysia.

Article by Kok Chee Kheong (Partner) and Tan Wei Liang (Senior Associate) of the Corporate Practice of Skrine.

1 The classification of MSME and MTC under the Roadmap is adapted from Institute for Capital Market Research Malaysia (ICMR) and based on definitions by SME Corp, MATRADE and the Ministry of Science, Technology and Innovation (MOSTI).

This alert contains general information only. It does not constitute legal advice nor an expression of legal opinion and should not be relied upon as such. For further information, kindly contact skrine@skrine.com.